Day trading is a stock market transaction that was originally only for professionals. It has become more popular with private investors since trading apps have made it easier and cheaper to trade quickly and make bets on the stock market. This is because high profits can be made in a very short amount of time. With day trading, there’s one thing that most people agree on: it’s a very risky business.

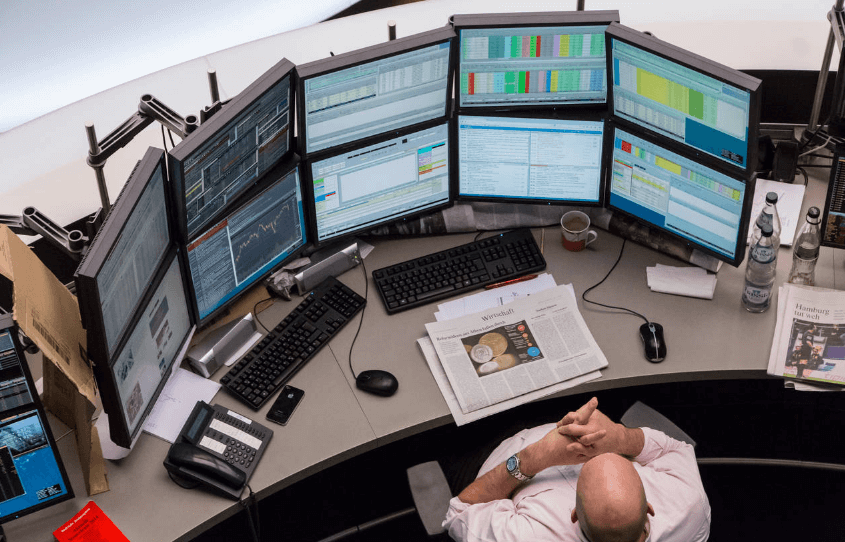

Day trading should only be done by experienced investors who have strong nerves, can handle stress, and know how the stock market works. If you start day trading in New Zealand, you need to be aware of the high risks and have the right tools. In this article, we discuss about the most important things about day trading: strategies, brokers, and more.

Day trading should only be done by experienced investors who have strong nerves, can handle stress, and know how the stock market works. If you start day trading in New Zealand, you need to be aware of the high risks and have the right tools. In this article, we discuss about the most important things about day trading: strategies, brokers, and more.

Best Day Trading NZ Brokers

What is Day Trading

Day traders enjoy the fast pace. They try to make a lot of money from small changes in the stock market. People who are day traders try to take advantage of small price changes by quickly buying and selling stocks. The term “day trader” is actually a lie. Because with day trading, not all of the stocks and bonds are bought and sold in one day. There are many different strategies used by day traders. They may hold their positions overnight or for a long time.

On the other hand, changes on the stock market don’t just happen in one day. If a stock loses money at the end of one trading day, it can lose more money on the next trading day. If a stock loses money the day before, it may be able to get back up the next day. There is a lot more to a day trader than just one day of trading. Stocks and their indices aren’t the only things that move quickly. Among other things, professional day traders also trade foreign exchange (Forex), cryptocurrencies, and other things.

Day trading vs. investing

The classic investor looks at things like the long-term growth of an industry, a region, a company, or a technology. Anyone who invests wants to make money in the long run from good company or industry news. They want to take advantage of short- and medium-term price changes, though. Day traders, on the other hand, want to make money. The difference is in the time frame. When you invest, you think about the future and try to make money. Stock exchange prices always show what people think about the stock market. For example, when a lot of people think that a good thing is going to happen, the price of a share always goes up. The price of a security is based on what people think about it in the future.

Get to know the day trading basics

Day trading in New Zealand is very easy to do because you only need a computer or smartphone, a broker, and a little money to start with. To make sure that the money doesn’t turn into less money with a few clicks, beginners should follow a few important principles:

- A demo account is a good way for you to get used to day trading before you start real money. Most well-known providers offer this kind of access with play money. Try out some strategies and pay attention to how well you do.

- Learn about the live account before you spend a lot of money. In the beginning, you should only trade small amounts of money. Because if you